LIBERTYVILLE, IL – (March 7, 2024) – AXSYS Capital, an emerging leader in medical property investments, is pleased to announce a successful initial closing of its premier AXSYS Capital Fund I, LP. The fund will focus on acquiring medical office buildings (MOBs) across the Midwest over the next 6-12 months, including Illinois, Missouri, Ohio and Wisconsin.

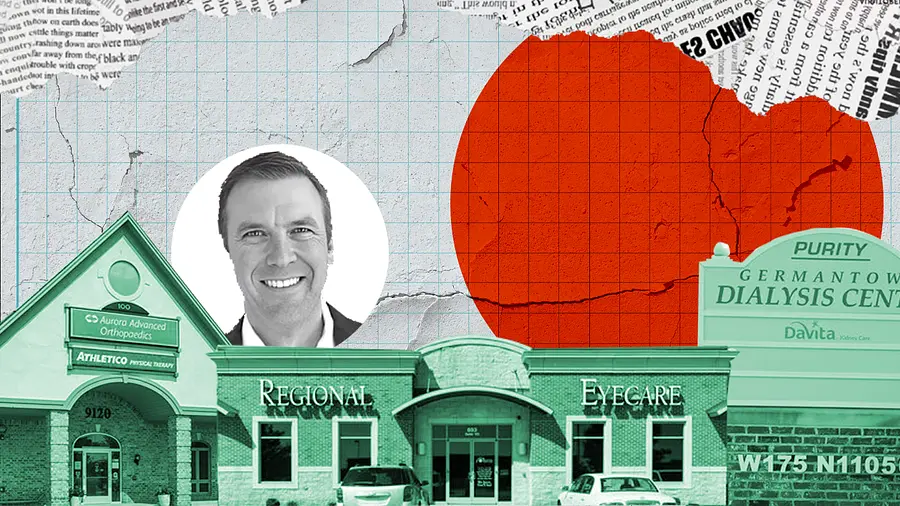

“The initial closing of AXSYS Capital Fund I enhances our firm’s capabilities and emphasizes our focus on identifying and capitalizing on properties we consider to be high quality, ‘recession-proof’ assets with stable, creditworthy medical and professional services tenants that we can hold long term,” said David Meggs, Co-Founder & CEO of AXSYS Capital.

AXSYS Capital has identified a niche in high-quality properties, primarily medical, in the $2M to $6M price point, that are off the radar of institutional investors and have above-market returns. To date, AXSYS Capital has successfully executed the acquisition, renovation, repositioning and sale of more than 25 transformative commercial and mixed-use properties across the Midwest totaling more than $74M.

The AXSYS Capital Fund I acquired three properties in the second half of 2023, including 853 Medical Drive in Wentzville, MO; W175 N11056 Stonewood Drive in Germantown, WI; and 9120-30 Loomis Road, Franklin, WI, respectively. These properties all contain a mix of medical and professional tenants with long-term leases in place.

“We believe that these types of properties can provide a hedge against inflation and add diversity to portfolios where so often there is an overreliance on the stock market via stocks and bonds,” added Meggs. Over the next few months, AXSYS Capital expects to close on up to five additional properties across the Midwest utilizing funds from AXSYS Capital Fund I.

About AXSYS Capital:

AXSYS Capital is a dynamic property investment company committed to unlocking strong risk-adjusted returns within an often-overlooked niche of the real estate market—smaller, suburban medical office and or “medtail” buildings. Rooted in the belief of cultivating robust investment portfolios, we employ a strategy centered on tangible assets that provide a compelling alternative for investors seeking diversification beyond the stock market. AXSYS Capital offers stability and growth through a meticulously curated selection of buildings home to primarily medical, financial, and insurance businesses—entities we consider “Amazon proof.”

What sets AXSYS Capital apart is our unwavering dedication to people and community. We understand the significance of fostering strong, enduring relationships with tenants and neighbors, recognizing that this commitment contributes directly to the vitality of our properties and, ultimately, the success of our investments. With affordable purchase prices and a proven model, AXSYS Capital stands as a beacon of stability and prosperity in the realm of property investment. For more information, please visit: https://axsyscapital.com/

Note: This document is intended for informational purposes only. It is not an offer to sell, or a solicitation of any offer to buy, any security, nor does it purport to be a complete description of the terms of or the risks or potential conflicts of interest inherent in any actual or proposed security or transaction described herein.