Category: AXSYS Capital In The News

St. Louis Business Journal: Big credit union acquires Des Peres site for local HQ

A big credit union based in suburban Kansas City has acquired a mixed use-office and retail property in Des Peres along the high-traffic corridor near the I-270 interchange for its St. Louis area “flagship location.”

AXSYS Capital recently closed on the sale of the land and 17,190-square-foot building at 11780 Manchester Road to CommunityAmerica Credit Union for $3.4 million. AXSYS bought the property in late 2016 for $2.1 million in a transaction financed by Carrolton Bank.

The deal is the latest foray in CommunityAmerica’s expansion into the St. Louis area market. The credit union, based in Lenexa, Kansas, opened a 2,340-square-foot branch earlier this month at 6510 Clayton Road in Richmond Heights, leasing the space from Creve Coeur-based SSM Health. It is a former Busey Bank branch.

CommunityAmerica plans to demolish the existing building at 11780 Manchester Road – known as Des Peres Plaza — and construct a two-story, 17,000 square-foot building with a basement that will house about 35 employees. The estimated cost will become more clear when the credit union receives proposals from contractors, said Whitney Bartelli, CommunityAmerica’s chief marketing and strategy officer.

There will be a first-floor branch and also commercial and business banking, wealth advisers, mortgage loan originators, and human resources, information technology, facilities and marketing to support the St. Louis area expansion, Bartelli said. Construction is set to start this fall on what Bartelli said will be Community America’s St. Louis area headquarters, likely to open in mid-2025.

CommunityAmerica last November purchased a former Lion’s Choice restaurant for $752,695 in Hazelwood at 5952 Howdershell Road. Demolition and construction of a 3,400-square foot branch will be awarded in May, along with work on the Des Peres headquarters. The goal is to open the Hazelwood branch by the end of the year, Bartelli said.

“We’re looking for additional property. We don’t plan to stop at three locations,” she said, saying the search is in St. Louis County but it’s unclear how many locations will be opened.

TWA origins, Cardinals partnership

The credit union is not a newcomer to the St. Louis area. CommunityAmerica has had a branch in Bridgeton for about three decades because it originally was the TWA Credit Union. That branch at 10895 Lambert International Blvd. is on the southern boundary of the airport and may have to close because of the $3 billion single-terminal being pursued by the city of St. Louis and the business group, Greater St. Louis Inc.

In March 2023, CommunityAmerica announced plans to open at least three new branches in St. Louis County. That coincided with the credit union unveiling a deal with the St. Louis Cardinals that made it the exclusive naming rights partner for the Cardinal’s Club, the area commonly known as the “green seats” at Busch Stadium.

Also, CommunityAmerica worked with the Big League Impact Foundation, founded by former Cardinals pitcher Adam Wainwright, to launch a promotion in April 2023 to benefit the foundation. The credit union also struck a deal with Wainwright in which he became an endorsement partner for CommunityAmerica. With Wainright’s retirement, shortstop Masyn Winn is the credit union’s new endorsement partner.

“That was a decision we made to reinforce the commitment we have to be a big player in St. Louis and to really aligning to what’s important to St. Louis,” she said.

Tapping into a region’s passion for sports to promote its brand is not new at CommunityAmerica.

The credit union is a major sponsor for the Kansas City Chiefs at GEHA Field at Arrowhead Stadium, the exclusive banking partner of the NFL franchise and its endorsement partner is quarterback Patrick Mahomes. In addition, the credit union is the exclusive naming rights partner of the Kansas City Royals’ Crown Club, which is the premium seating behind home plate at Kauffman Stadium. Shortstop Bobby Witt Jr. is the credit union’s official spokesman.

CommunityAmerica has $4.7 billion in assets, about 321,000 members, 34 branches and about 850 employees.

David Meggs, CEO of AXSYS Capital — based in the Chicago suburb of Libertyville, Illinois — said Des Peres Plaza yielded an annual internal rate of return of about 32%. He said it is representative of the small-to-mid-sized properties that AXSYS typically buys and holds long-term with the “focus of providing consistent cash returns” to its investors.

Meggs learned about the region’s commercial real estate market as he earned his master of business administration degree in international business from Saint Louis University in 2010. He also worked in St. Louis for Solae LLC from 1997 to early 2004.

John Shuff of Pace Properties and Ted Green of Avison Young represented the buyer, CommunityAmerica, in the transaction. Mark Dorsey of Avison Young along with Luke Grant and Jason Riegelsberger of Skyline Missouri Realty represented the seller, Des Peres Plaza Partners, LLC on behalf of AXSYS Capital.

Traded: AXSYS Capital Appoints Marc Fiedler as Director of Acquisitions and Asset Management

Commercial Property Executive: AXSYS Capital Closes Fund for Midwest MOBs

Traded: AXSYS Capital Announces Initial Closing of AXSYS Capital Fund I, LP

LIBERTYVILLE, IL – (March 7, 2024) – AXSYS Capital, an emerging leader in medical property investments, is pleased to announce a successful initial closing of its premier AXSYS Capital Fund I, LP. The fund will focus on acquiring medical office buildings (MOBs) across the Midwest over the next 6-12 months, including Illinois, Missouri, Ohio and Wisconsin.

“The initial closing of AXSYS Capital Fund I enhances our firm’s capabilities and emphasizes our focus on identifying and capitalizing on properties we consider to be high quality, ‘recession-proof’ assets with stable, creditworthy medical and professional services tenants that we can hold long term,” said David Meggs, Co-Founder & CEO of AXSYS Capital.

AXSYS Capital has identified a niche in high-quality properties, primarily medical, in the $2M to $6M price point, that are off the radar of institutional investors and have above-market returns. To date, AXSYS Capital has successfully executed the acquisition, renovation, repositioning and sale of more than 25 transformative commercial and mixed-use properties across the Midwest totaling more than $74M.

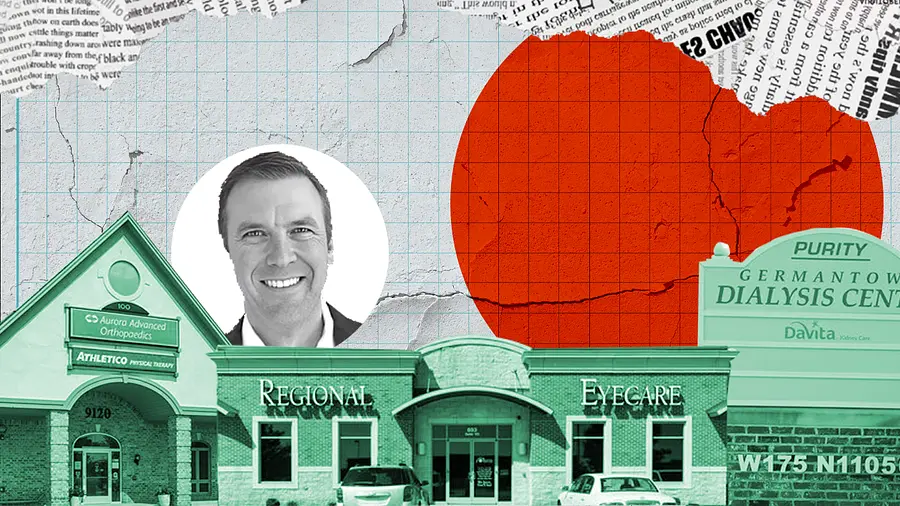

The AXSYS Capital Fund I acquired three properties in the second half of 2023, including 853 Medical Drive in Wentzville, MO; W175 N11056 Stonewood Drive in Germantown, WI; and 9120-30 Loomis Road, Franklin, WI, respectively. These properties all contain a mix of medical and professional tenants with long-term leases in place.

“We believe that these types of properties can provide a hedge against inflation and add diversity to portfolios where so often there is an overreliance on the stock market via stocks and bonds,” added Meggs. Over the next few months, AXSYS Capital expects to close on up to five additional properties across the Midwest utilizing funds from AXSYS Capital Fund I.

About AXSYS Capital:

AXSYS Capital is a dynamic property investment company committed to unlocking strong risk-adjusted returns within an often-overlooked niche of the real estate market—smaller, suburban medical office and or “medtail” buildings. Rooted in the belief of cultivating robust investment portfolios, we employ a strategy centered on tangible assets that provide a compelling alternative for investors seeking diversification beyond the stock market. AXSYS Capital offers stability and growth through a meticulously curated selection of buildings home to primarily medical, financial, and insurance businesses—entities we consider “Amazon proof.”

What sets AXSYS Capital apart is our unwavering dedication to people and community. We understand the significance of fostering strong, enduring relationships with tenants and neighbors, recognizing that this commitment contributes directly to the vitality of our properties and, ultimately, the success of our investments. With affordable purchase prices and a proven model, AXSYS Capital stands as a beacon of stability and prosperity in the realm of property investment. For more information, please visit: https://axsyscapital.com/

Note: This document is intended for informational purposes only. It is not an offer to sell, or a solicitation of any offer to buy, any security, nor does it purport to be a complete description of the terms of or the risks or potential conflicts of interest inherent in any actual or proposed security or transaction described herein.